What is the relationship between date of incorporation and financial year end date ?

Do you know that date of incorporation and financial year end date is ” tied up together “?

👉 Date of Incorporation

You are free to decide date of incorporation.

Please take note that this date is UNCHANGEABLE after company registered.

👉 Date of financial year end (FYE)

FYE date is refer to when company close their accounting period .

All company is free to decide when to close their account for compliance reporting purposes.

Normally FYE is consist of 12 months accounting transaction.

Example if DOI is July 2024 and 1st FYE will be June 2025

You many apply to change financial year end date subject to ACRA approval.

Can it be less than or more than 12 months?

Yes. Of course you can .

But please take note that less than or more than 12 months will have huge impact on company tax especially if your company making profit.

Let see the following example :

Based on above table, YA refer to year assessment and is used by IRAS as key indicator to determine tax payable period .

As you can see, IRAS will breakdown all YA in 12 months .

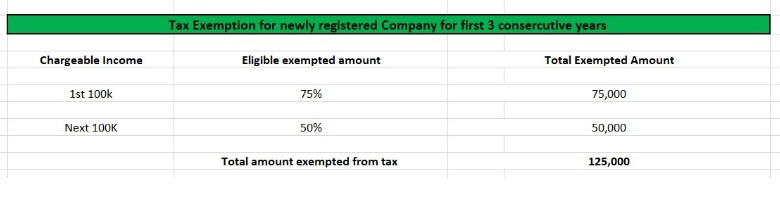

All newly registered company is eligible for tax exemption for first 3 consecutive years as follow :

Am i qualify for tax exemption ? click here

What is the different for company with revenue 250k BUT with different financial year end date ?

If you fixed the FYE date as December,

You may waste the 1st 100k tax exemption as there is unlikely company can earned more than 100k within 6 months