How To Fixed Accounting Year End

Financial Year end refer to the date when the Company closed their Accounting year . Most of the Company will fixed it on calender year basic , 12 months .

The reason behind to fixed the year end , is to ease the Company management to :

-judge company performance

-identify weakness and fixed it

-planning for next year

-better budget control

-to meet authorities compliance

How do we fixed year end ?

Authority have not imposed any measurement on this.

It is up to management to decide their accounting year end period , it can be more that 12 months or less than it .

However ,we strongly suggest to fixed the year end within 12 months to alight with IRAS tax exemption benefit

Example :

Date of incorporation is on 1 April 2018

Scenario 1

Accounting Year End Fixed on 31 March 2019

Accounting period covered 12 months

IRAS will treated as 1 Year Assessment (YA)

Scenario 2

Accounting Year End fixed on 31 December 2018

Accounting period covered less than 12 months

IRAS will treated as 1 Year Assessment (YA)

Scenario 3

Accounting Year End fixed on 30 June 2019

Accounting period covered more than 12 months

IRAS will treated as 2 Year Assessment (YA) :

1 YA from 1 April 2018 till 31 March 2019

2nd YA from 1 April 2019 till 30 June 2019

Which scenario is better ?

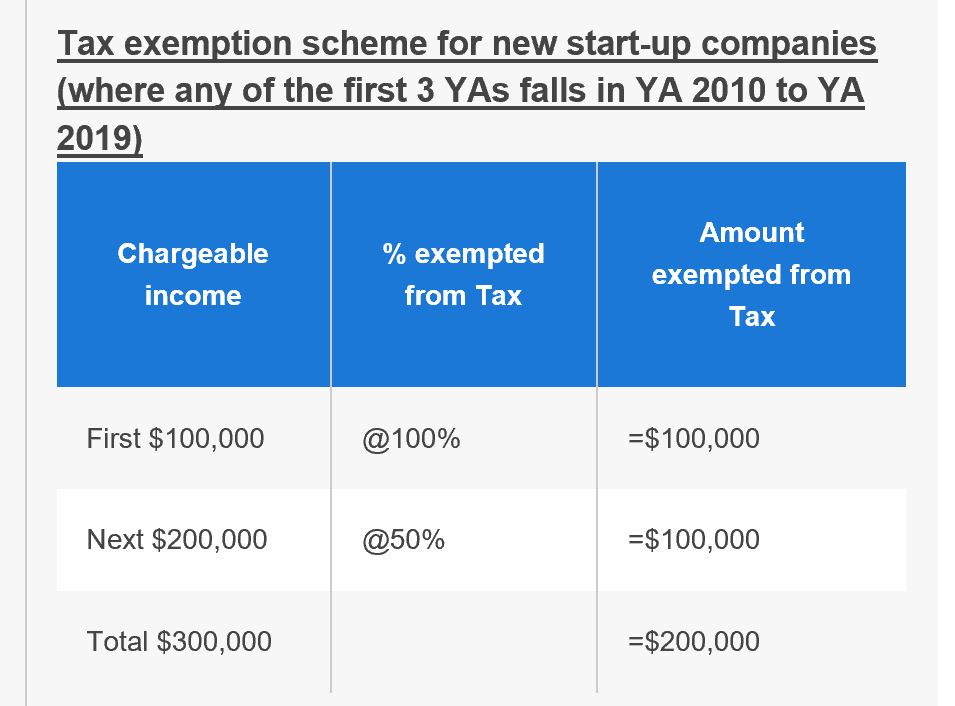

The key factor here is how much the Company’s chargeable income will be ?

If Company’s chargeable income is expected more than 100k, is adviseable to fixed the year end within 12 months to enjoy tax exemption .

Example :

Date of Incorporation : 30 April 2018

Accounting Year end Fixed : 30 June 2019

Company’s Revenue 350k

1 YA : 30 April 2018 till 31 March 2019

($100k will be 100 % tax Exemption )

2 YA : 1 April 2019 till 30 June 2019

($250k will be 50% tax exemption )

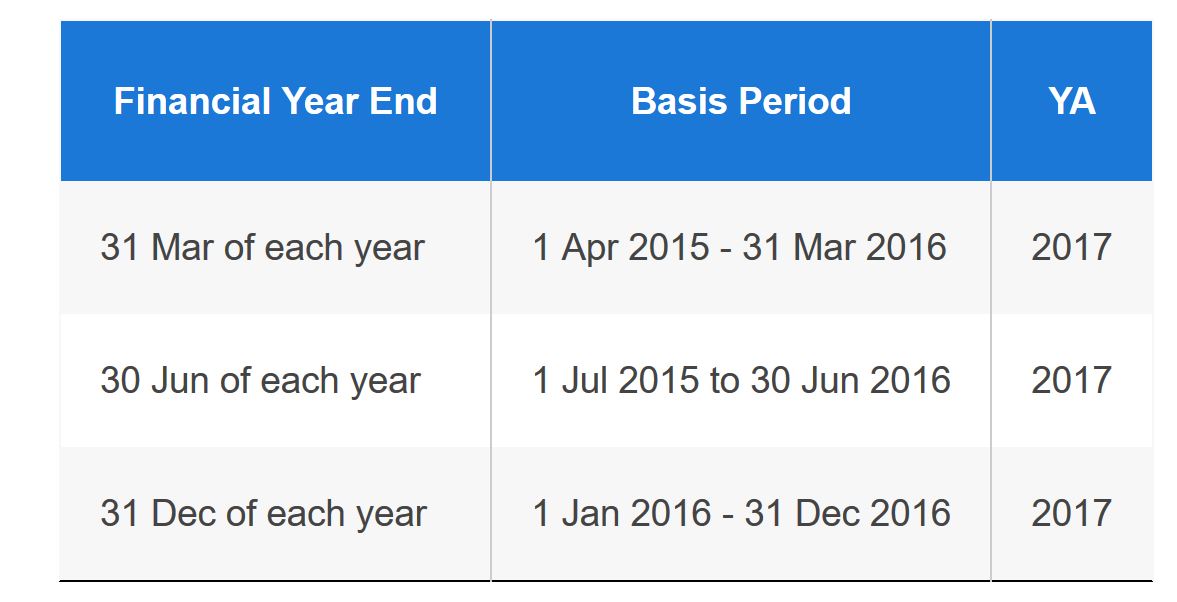

Accounting Year end vs Year Assessment (YA)

Public always confuse about accounting Year end and Year Assessment (YA)

‘Year of Assessment’ (YA) refers to the year in which income tax is calculated and charged. The assessment is for the income earned in the preceding year, starting on 1 Jan and ending on 31 Dec.

Example :

Accounting year end is 30 June 2017

Year Assessment will be 2018

Related Article : Important of Financial Year end