WHAT IS AUDIT EXEMPTION

CHANGE IN AUDIT EXEMPTION

GREAT NEWS for all Singapore registered Company, Audit exemption criteria will enhance to Company with turnover S$10 million . This reform will benefit approximately 25,000 companies in term of their operation cost , auditing fees.

The first phase of reform will take effect with financial year start from 1 July 2015 and after.

BEFORE

ONLY Exempt Private company with the following criteria is eligible to :

- annual revenue is S$5 million or less

- not more than 20 member

- no corporate shareholder

AFTER

Introduction of new concept “SMALL COMPANY “

Any company qualified ANY 2 of the following criteria for immediate past 2 financial year

- Total annual Revenue is S$10 million or less than

- Total asset is S$10 million or less than

- Number of engaged employee is 50 or less than

What if company is part of Group Companies ?

- must meet ANY 2 of “SMALL COMPANY” criteria AND

- entire group must be term as “small group”

” Small group” refer to the company able to meet at least 2 of the “Small company” concept on a consolidated basis for the past 2 consecutive financial years

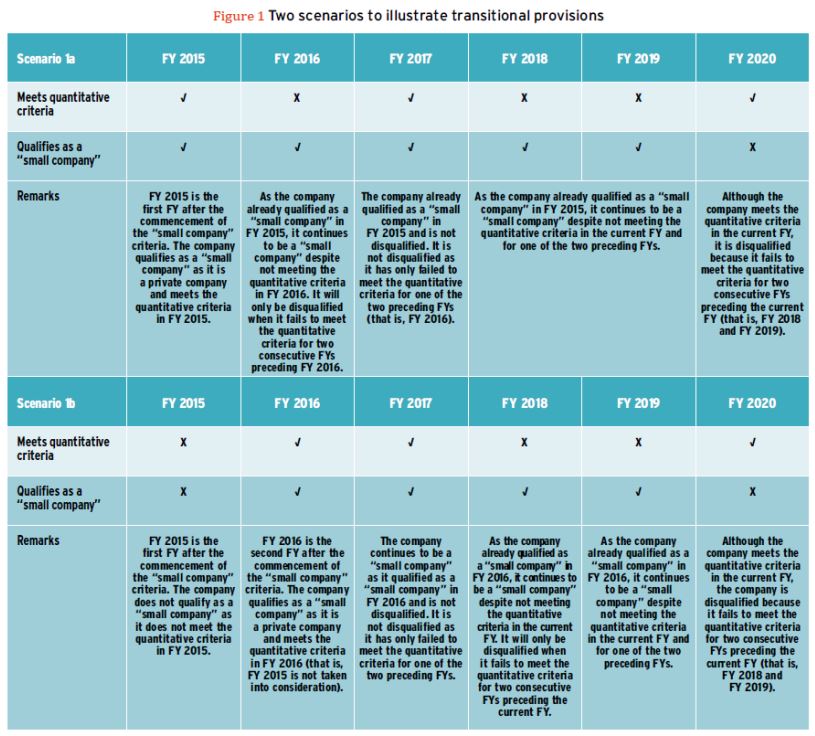

Following table shown Transitional provisions for existing companies ( Information from ACRA website)

Please click here about FAQ.

Related article :

Todayonline -Companies Act Reform

ACRA News release – Companies Act Reform